February 2020 Prayer Alert

The 2020 session of the Illinois General Assembly is now underway in Springfield. Our state lawmakers are introducing new proposals, adding to the 6,000+ bills that were introduced in the first half of the session (2019). IFI’s top concern is stopping the effort to repeal the Parental Notice of Abortion Act. In a recent email, the anti-life Personal PAC told their supporters that their

key goals in 2020 will be repealing dangerous anti-choice legislation and safeguarding reproductive rights for future generations. With that in mind, in the next few months, Personal PAC will be focused on:

- Repealing the Parental Notice Act of Abortion (PNA) and

- Expanding the Illinois General Assembly’s pro-choice majority

Opposing this horrific agenda must be a prayer priority for all pro-life Christians in the state. It must also become a tier one call-to-action for us all. Our local state representatives, state senators and Governor J.B. Pritzker must hear from us loud and clear. They must come to understand that we will not remain silent as they work to usurp our God-given parental rights so they can pursue an agenda of death.

In addition to that, ethics reform is once again making headlines in the wake of multiple FBI corruption investigations and numerous indictments. Chicago’s ABC7 I-Team recently aired a report identifying Illinois “as the most corrupt state in America.” Political pundits speculate that there will be more indictments coming in the weeks and months ahead. As if that weren’t enough, Illinois House Speaker Michael Madigan is at the center of a rape cover-up scandal that may have far reaching consequences.

We also have critically important primary campaigns going on now through election day, March 17th.

To say we have much to pray about is an understatement. Our state government is immersed in chaos and corruption. This is a reflection of the character of the men and women serving in Springfield over the past several decades. We are to pray for all those in authority, that we may live peaceful and quiet lives in all godliness and holiness, (1 Timothy 2:1-2).

Please Pray:

- That God will open the eyes of policy-makers and candidates for office to the sanctity of life. Pray that they will become defenders of innocent human life and not enablers of sexual immorality and death.

- That state lawmakers will uphold parental rights and reject attempts to repeal the basic protection young women have in the Parental Notice of Abortion Act.

- That federal and state investigators will root out all corruption at the Capitol and among our legislators and that self-serving lawmakers will be replaced by honest and wise public servants.

- That in the 2020 election season, pro-life candidates will have the time, energy and funding needed to saturate their districts with their campaign messages and materials.

- That God will give wisdom and discernment to the honest public servants in Springfield who must work in the swamp of corruption and that they have courage to serve the Lord with fear and trembling and not shrink back from calling out every form of wickedness. (Psalms 2:10-11)

- That many godly counselors and advisers will surround our elected officials and that local pastors and Christian leaders will intentionally seek opportunities to visit and minister to these men and women. (Proverbs 11:14)

- That God will work in the hearts and minds of our state lawmakers and governor and that He will draw them to Him and His truth. (Proverbs 21:1-8)

- That God will work in the hearts of key federal officials, including President Donald Trump, U.S. Senate Majority Leader Mitch McConnell, U.S. Senate Minority Leader Charles Schumer, U.S. House Speaker Nancy Pelosi and U.S. House Minority Leader Kevin McCarthy.

- That efforts to indoctrinate children in government schools–especially the new law that mandates teaching about homosexuality and the “trans” ideology positively in government schools–will fail and that local school boards will reject this agenda for their students in kindergarten through 12th grade.

- That God will use the upcoming IFI Worldview Conference and April 25th Education Forum to help equip and challenge parents, grandparents and pastors.

Personal Prayer Request:

Last week, my wife and I were blessed with the birth of our son, Owen. He was born with Down Syndrome and has significant medical challenges. We learned that Owen had an imperforate anus and an AV canal defect in his heart. Owen had surgery on his second day of life and spent the next six days in the PICU. He is facing three additional surgeries in the next several months.

Owen has also been diagnosed with transient abnormal myelopoiesis (TAM). We were told that twenty percent of Downs Syndrome kids develop Leukemia but 80 percent outgrow it. Further blood tests will indicate more.

We would greatly appreciate if you would keep baby Owen in your prayers over the next several months. We praise God for the technology and science and the amazing medical team that has worked to save Owen’s life and help him overcome these health hurdles.

God is stretching the Smith family in new and exciting ways. We are walking in faith, trusting in God’s plan for Owen while trying not to rely not on our own (finite) understanding. I can honestly say that we cannot wait to see how God is going to use this boy in our family and beyond.

Subscribe to the IFI YouTube channel

and never miss a video report or special program!

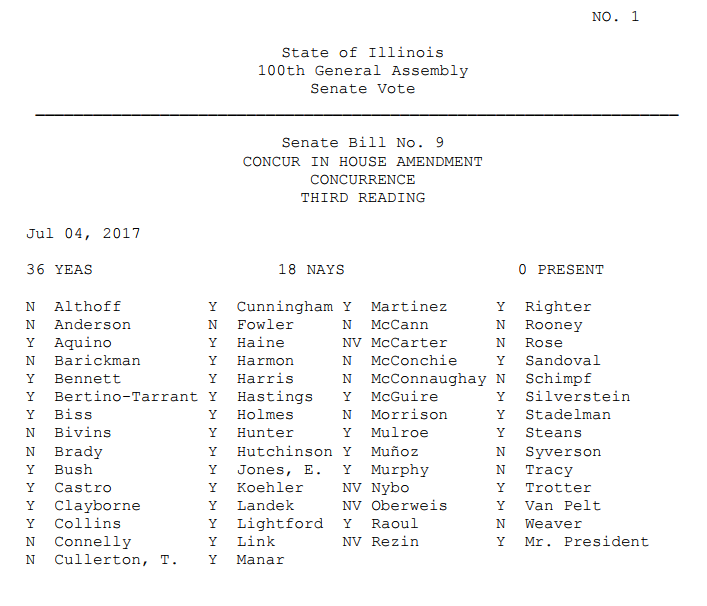

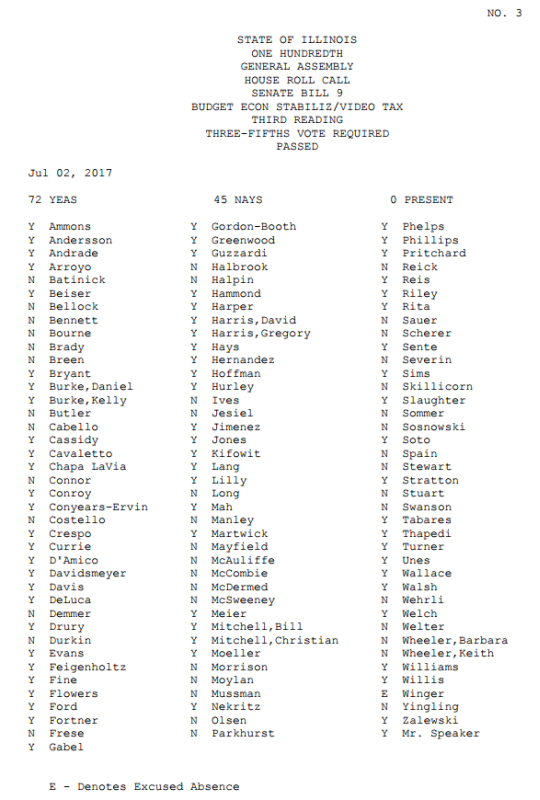

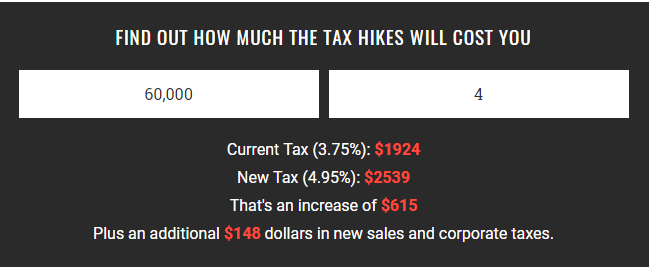

In order to better celebrate Independence Day weekend, Illinois taxpayers may want to avoid reading the details of what our elected officials have once again produced. Perusing just

In order to better celebrate Independence Day weekend, Illinois taxpayers may want to avoid reading the details of what our elected officials have once again produced. Perusing just

Download the IFI App!

Download the IFI App!