Last time when we focused on the writings of government employee compensation expert Bill Zettler, I failed to mention that Bill had some great lines over the years, such as:

“Economics always wins.”

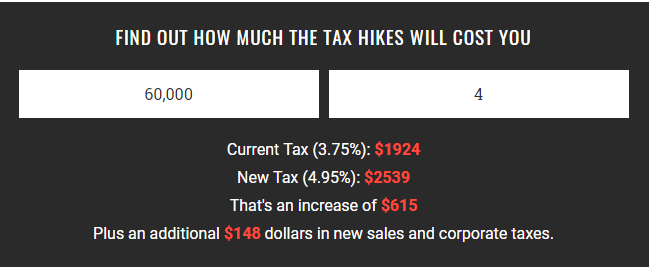

Despite the wishes and dreams of people on both the political left and political right, the day of accounting always comes. We are at that day right now as taxpayers face hundreds of billions of dollars in unfunded pension liability. (Read this if you think that under-funding is due to a failure on the part of taxpayers. It’s not.)

“If something is impossible,” Bill also said, “it’s not going to happen.” There is no way all the state pensions will be paid. In fact, those government employees who are already retired and collecting their generous pensions are stealing from future pensioners.

Were you aware of the fact that twenty-five percent of our state’s budget currently goes to fund government employee pensions? In other states the number is about four percent.

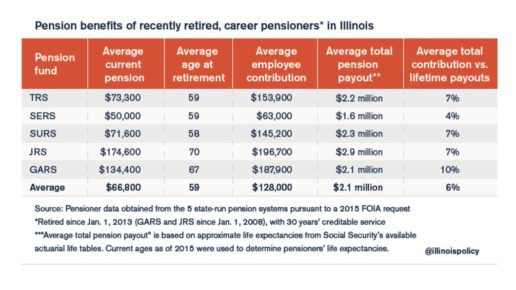

The math doesn’t work and cannot be made to work. If you want to learn more about just how bad the pension system currently is, I would encourage you to check out the annual pension study conducted by Taxpayers United of America. One of the best resources they provide is the list of retired government employees whose pensions are over $100,000.

Are you ready for this? There are currently 17,000 of them — and the number goes up every year.

Here are the leaders from each of the top five levels — $500k, $400k, $300k, $200k, and $100k:

Leslie Heffez’s current annual pension is $581,227. Leslie paid in $768,611, and can expect to get out $21,945,104 in lifetime benefits based upon life expectancy averages.

Das Gupta’s current annual pension is $494,773. It took only one year for Das to recoup everything he paid into the system, which was $475,331. He could receive $5,290,301 before the grim reaper comes calling.

Herand Acarian gets $392,682 every year. Not bad for having paid in only $628,987, and with a good long life, Herand could get back $6,843,239 or more.

Eddie Williams wins the $200k column, bringing in six times the annual average Illinois household income (which is approximately $50k) at $299,991. Eddie coughed up a whole $277,792 to invest into the system, and has already received $842,452 in benefits. (Please read those numbers again.) If he stays healthy, he could cash in for as much as $5,527,649 over his lifetime.

After flipping through over four full pages of pensions exceeding $200,000, Rick Taylor tops off the $100-k’ers at an annual pension of $199,909. For the record, Ricky paid in $229,400, has already received $1,162,854 (he retired at age 56), and life expectancy charts could gift him $7,267,441 or more if he eats right and gets enough exercise.

Hello?

For the most up to date information about where the state’s pension systems stand now the place to go is the Illinois Policy Institute’s website. For several years now, their researchers have been firing off warning flares about the dangers ahead. How Republican and conservative state legislators, let alone our Republican governor, have failed to notice, is a mystery.

If they had noticed, the problem would constitute a big part of their message to their constituents and the hard working families around the state.

There are proposed reform bills, but they all fall way short. To be honest, it’s as if the authors are not reading the works of Bill Zettler or the Illinois Policy Institute.

As for Governor Bruce Rauner, he boasts continually about wanting to spend more money on the K-12 system.

Where does he think a lot of that money is going?

I’ll give you one guess. That level of ignorance is almost incalculable. More money for the worst run level of government in the state?

The solution is a push for universal school choice where the money follows the student. That is where the savings will come, as Illinois families will be freed from the government school monopoly, and move to more economical and effective education options. Short of that, Rauner will never fulfill his constitutional duty to propose a balanced budget.

If Republican leaders had truly noticed those IPI and Bill Zettler warning flares, they would have spent the past many years making sure that enough Illinois taxpayers would be informed and thus demanding that the problem be fixed.

Read Part 1 — There is No Excuse for the Failure of Reform

Up next: More about the Illinois pension scam.

A bold voice for pro-family values in Illinois!

Click HERE to learn about supporting IFI on a monthly basis.

We recently alerted you to two pending pieces of legislation that Governor Bruce Rauner will soon have to grapple with. If you have not yet responded to this call-to-action, or even if you have, it is imperative that his office hears from us emphatically and frequently.

We recently alerted you to two pending pieces of legislation that Governor Bruce Rauner will soon have to grapple with. If you have not yet responded to this call-to-action, or even if you have, it is imperative that his office hears from us emphatically and frequently.

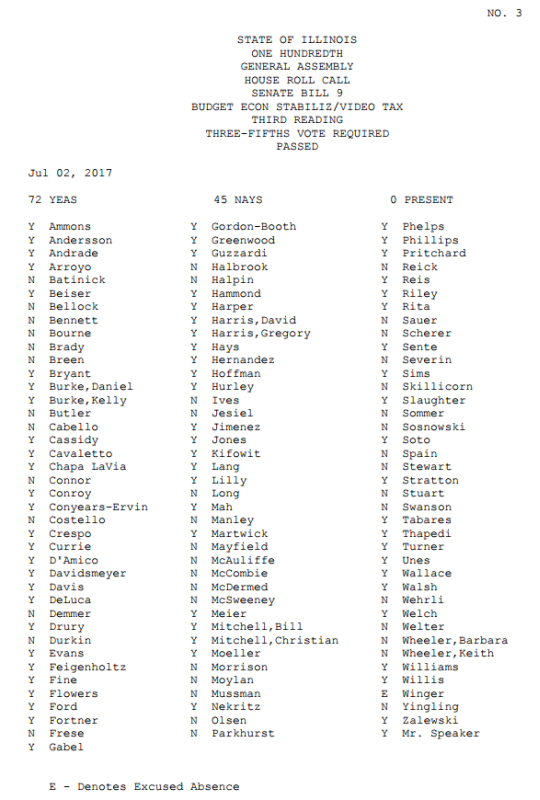

In order to better celebrate Independence Day weekend, Illinois taxpayers may want to avoid reading the details of what our elected officials have once again produced. Perusing just

In order to better celebrate Independence Day weekend, Illinois taxpayers may want to avoid reading the details of what our elected officials have once again produced. Perusing just